Generate Consistent Income from Trading is difficult. This is how I achieved it

Making money in trading is difficult but with right strategy and mindset, you can achieve it.

Work from anywhere and money flows in their bank account, this is the freedom everyone wants. Trading not only helps to achieve that but it helps to build a solid income stream too for them.

But the harsh reality is that 60% of traders lose their entire capital within the first years. Rest 30% within next 2 years.

“So what can we do to keep ourselves in those 10% profitable trade?”. This is the question that everyone needs to answer.

In this article, I will tell you what I do and how I achieve consistency through trading in my life.

Before I tell you this, let me tell you how it all started…

Starting of My Journey as an Active Trader

As I shared above, trading gives you the freedom to work from anywhere. This is the starting point of my trading journey.

Due to some family commitments, I couldn’t pursue my career as a 9–5 office-going guy. So I started finding a way that fulfil my requirements.

I found trading was my first choice when I shortlisted a few options. Now the question is, how to start trading as a full-time career? It was the year 2010. At that time, there are very limited resources from where we can learn a new skill.

So I followed the path that everyone followed at that time. I went to a broker and opened my trading account. My intention was that a broker would help me to learn how to do profitable trading.

I still remember that my RM suggested to trade in options and my first trade was a Call Buy of Nifty.

It was a loss-making trade obviously. 😜 But in the next few months, I understand one thing, if I want to succeed in this market I need to learn first.

I started reading books about technical analysis because this was the only thing I could understand at that time.

But the real change came when I read "Come to My Trading Room by Alexander Elder". It changed my mindset completely. It showed me, how trading psychology plays an important role in our trading journey.

There was no look back then. After spending 4 years, I was at a stage where I was making consistently through futures trading. At that time I was doing intraday only.

I have created a few trading setups (I will share my trading system another day). I optimised these based on my knowledge, experience or whatever the market was teaching me.

Obviously, I made some blunders but I learned from them and made a habit not to repeat them.

During this time, I only focused on futures, especially for intraday. Many times I got distracted by some other asset class but I knew from the very beginning that if I wanted to succeed, I had to follow my own path. So I stick to futures for intraday till I reach at a stage when I'm generating consistent income from it.

From Futures to Option Strategies

The journey to reach there was not easy. I created many systems, but mostly I followed technical analysis (I will share my trading setup some other day). I did optimisation based on my understanding and knowledge or whatever the market was teaching me. And then finally I achieved that success.

Now when I was trading futures for intraday, I found that somewhere I’m missing the entire trend and booking profit too early due to my intraday timeframe. If I hold my trade for a few days, I can utilise that entire trend more effectively.

But if you trading the future especially for positional, there is a huge risk due to some gap-up or gap-down opening. So I started finding a way to protect my capital from any unexpected movement.

When I went a little deeper, I found that we can hedge futures with options and this was the game-changer for me.

I took a Mentorship Program to learn everything about option hedging strategies.

Till that time I was focusing on finding the trend and momentum but when I learnt options, I found that 70% time market consolidates in a range and if we can make some delta-neutral & theta-long strategies, we can easily achieve our monthly target while keeping our position with proper hedge.

This feeling brings me the satisfaction that when my entire portfolio is hedged, I can sleep peacefully at night without any worry about where the market will open tomorrow.

Earlier, I was tracking so many things like global markets, SGX Nifty, following domestic and global news etc... But with options hedging strategies, I don't need to predict anything. I can just react based on the Market movement.

Now, my trading has become more stable and stressfree. And I think this is why we want to achieve in the end.

“A streak-free trading that is generating alpha for us month after month.”

My expectations from trading are not very high. A 3–4% monthly return with 1–2% portfolio risk is enough for me and we can achieve that easily by keeping risk on the limited side through these option hedging strategies.

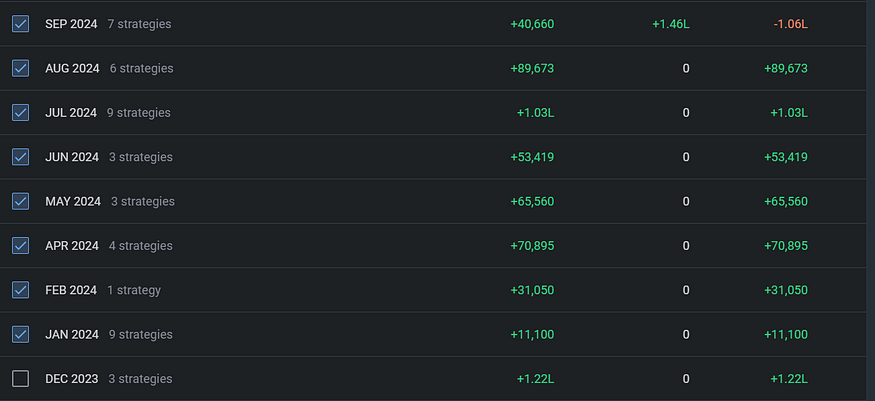

Look at the below performance:

The above performance is based on 30 lakh deployed capital. It averaged 3% monthly in the last 10 months. And don’t forget I’ve kept max 2% risk for my entire portfolio at a time.

Now it’s almost 6 years since I’ve traded completely through option heading strategies.

How you can achieve this success?

In a world where trading frequently promises quick riches and easy profits, the reality is much more difficult. A significant number of traders struggle to generate consistent profit, succumbing to psychological turmoil and market volatility. However, few have successfully navigated this dangerous terrain and became victorious.

My Journey to Trading Mastery

My path began with a goal for financial independence and a great curiosity about financial markets. Like many others, I became fascinated by the tempting prospect of trading, looking for a life of passive income and endless possibilities.

However, the path to success was not without challenges. I had numerous setbacks, learned from my mistakes, and developed a resilient mindset. Years of serious study, practice, and indestructible commitment helped me hone my trading skills and develop a long-term strategy for generating regular income.

Key Strategies for Success

- A Solid Foundation: A solid foundation in financial markets, trading psychology, and technical analysis is required. Understanding the underlying ideas and dynamics will allow you to make informed decisions.

- Risk Management: Prioritizing risk management is essential. Setting realistic stop-loss orders and restricting position size can help you protect money and avoid serious losses.

- Optional Hedging: Including option hedge strategies in your trading toolkit can provide a substantial advantage. These strategies can help you safeguard your portfolio from market volatility while still generating consistent returns, even in adverse market situations.

Accelerate Your Learning with Option Strategies: A Mentorship Program 3.0

If you’re serious about bringing your trading to the next level, join Option Strategies: A Mentorship Program 4.0. This comprehensive program is intended to offer you with the knowledge, resources, and support you require to maintain consistent profitability.

Key Program Benefits:

- Expert Mentorship: Learn from seasoned traders with a successful track record.

- Personalized guidance: Receive personalized advise based on your learning style and goals.

- Comprehensive Curriculum: Develop a thorough understanding of option strategies, risk management, and market analysis.

- Live Trading Sessions: Watch and learn from real-time trading scenarios.

- Community Support: Meet like-minded traders and share your experiences.

Join Option Strategies: A Mentorship Program 4.0 today and unlock your potential for consistent trading success.

Disclaimer: Trading involves risk, and past performance does not guarantee future results. It’s essential to conduct thorough research and consider your risk tolerance before making any investment decisions.